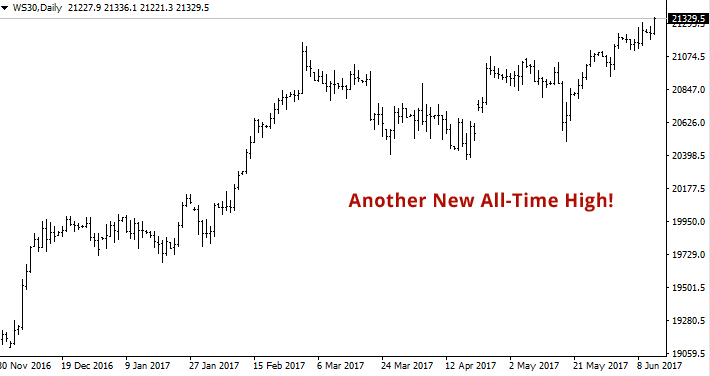

Dow Jones Index Hits New All-Time High As Fed Prepares to Hike

Another day and another new all-time high for the Dow Jones industrial average index. It seems like groundhog day with this strap line, but here it goes again. The DJIA was buoyed by tech stocks rebounding in tremendous fashion, with the Nasdaq 100 also pushing higher after a few days of the wobbles.

Movers within the index were 3M and Goldman Sachs, posting the most gains. But technology stocks were back, and with a bang. As out-performers on the year so far, it was no surprise to see some relief as the S&P information technology sector has already gained 17.6 percent this year to date.

But tomorrow is the big day. The Federal Reserve will make their quarterly interest rate announcement tomorrow, with expectation that the central bank is going to raise interest rates by a quarter point.

How this will affect the Dow Jones index is hard to predict. Some commentators are saying the Dow Jones has already priced in a rate hike, some are saying brace for a sell on “event” type move. But all we can do is “wait and see”.

It would be foolish not to expect some sort of correction in value of the blue chip stocks in the Dow Jones index. If you look at the chart below, you would have to say it’s gone way (way) higher than anyone could have predicted before President Trump won the election. That doesn’t mean it can’t go higher, but how much?

In the past, shocks from interest rate decisions have been one of the main catalysts for a surge in the opposite direction for stocks. When interest rates are hiked by a higher percentage than what was expected it can cause a sell off.

But right now the Federal Reserve are playing it cool and calm. No shocks, no large jumps. Just sneak those rates up as quarter points, in a gradual and timely fashion. Maybe this is allowing investors to digest the changes, and continue to hold a bullish stance? Well, no one else seems to have a firm answer as to why the markets are going so high. It is as good as any other explanation.

Until next time…

About Pete Southern

Pete Southern is an active trader, chartist and writer for market blogs. He is currently technical analysis contributor and admin at this here blog.

Most Popular Content

- Gold and Copper Prices Dip Amid Trade Turbulence and Tariff Worries

- Copper Prices Hit New Heights Amid Global Trade Tensions

- Oil Markets Respond to OPEC+ Production Signals as Prices Find Support

- Gold Prices Reach Record Highs Amid Economic Uncertainty and Volatility

- Pressure Mounts on the British Pound Following Autumn Budget

- Impact and Outlook for the U.S. Economy on Rate Cut

- Gold and Copper Markets Respond to Powell

- US Stock Market Faces Turbulence and Mixed Commodity Reactions

Currency Articles - Nov 3, 2024 13:35 - 0 Comments

Pressure Mounts on the British Pound Following Autumn Budget

More In Currency Articles

Gold and Oil News - Apr 5, 2025 15:06 - 0 Comments

Gold and Copper Prices Dip Amid Trade Turbulence and Tariff Worries

More In Gold and Oil News

- Copper Prices Hit New Heights Amid Global Trade Tensions

- Oil Markets Respond to OPEC+ Production Signals as Prices Find Support